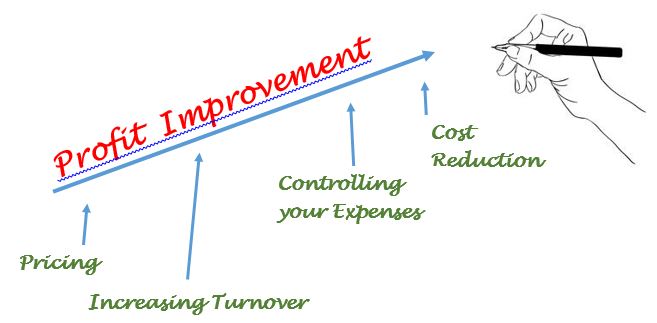

End Of Year Profit Improvement

Has the end of the year been dismal for your business?

I have had so many discussions over the last few months with many who have not had a great year. How can you change for next year if the economy for you is not great?

If you want your business to bring more money in, there are several ways you can increase Sales however we will talk about that next month!

This month let’s just briefly look at 4 things that might help you:

- Increasing Turnover Briefly

- Pricing

- Gross Profit Margin

- Controlling Fixed and Variable Expenses.

Increase Your Revenue:

- Sell Yourself: Before anybody is going to buy from you or your company, they’ve got to “buy” the idea that you’re somebody worth working with. In other words, just like a job candidate, your first task is always selling yourself. A great starting point is to Create a Story so that people know what and why you were driven to create your business in the first place. Research your target and know exactly what they are after within your service or particular products. Always be Professional – this will go a long way creating potential and keeping current customers.

- Know your own mindset. Amazing how many set their sites too low and wonder why they can not achieve the $1m turnovers. Often when talking to people they want a big business but they are thinking small.

- Increase your number of customers: This can be achieved by rethinking your Marketing message and Advertising. If you have been using the same old marketing strategies for yonks, and getting nowhere fast, then maybe it is time for a change. There are plenty of ideas out there you just need to find what works for you. Read our next Blog on sales! Are you targeting the right message? Does the right customer know the benefits of what you are selling and why they should buy from you?

- Improve Your Product/Service: If you sell variable products/services then do some brain storming on ways that your service/products could be improved. Visit websites of rival companies and compare what they are offering compared to your business. Are they offering something different that you could add to your service? Do some research and you will be surprised with what you might find out there – even in other countries.

Pricing and Margins:

- Raising Your Prices:

I have heard it over and over and once again yesterday!“I can’t raise my prices, but now I have to because I haven’t done it for years”. or “Our COG has just risen 10% our customers can’t handle that” There are 3 parts at least to this story.

- Yes there are pricing points.

- In slow times people are sometimes slower at buying.

- Is our own mindset around our value or our product value.

I have so many cases where businesses don’t raise their prices out of unnecessary fear.You are in business to make a PROFIT not to make a LOSS!!!

The trouble is if you allow your gross margin to fall low then your profit also falls.Are you better off selling less and making more gross profit (with a slight price rise) or selling less and making less gross profit while your COGs continues to rise?I believe if you review your price yearly with that little increase of even CPI you will not fall behind the 8ball as much and often can handle the COG price increases without your customers dropping off in sales.

The most well-known indicator of inflation is the Consumer Price Index (CPI), which measures the percentage change in the price of a basket of goods and services consumed by households. In Australia, the CPI is calculated by the Australian Bureau of Statistics (ABS) and published once a quarter. If your costs are continually going up and you never raise your prices to meet those costs, then your business will soon be losing money.

If you run your pricing with the CPI each quarter or even yearly then it will be a minimum price increase compared to a big hit to your customers. So, if you haven’t increased your prices for a number of years then take the step and start doing so regularly. Smaller, frequent price increases are much easier for customers to handle rather than large price increases every few years. This also means that as your costs to run your business increase you are better equipped to handle the costs from your own price increases.

Controlling your expenses

How often do you compare prices for your expenses such as insurance, power, electricity – many of these we think of as fixed!!! We can’t change BUT I am a great believer in the 3 supplier rule. Sure your broker is meant to do that – yea. Go to the trouble of checking yourself! Ring the Telcos – which one will do the best deal to suite you?

Controlling your variable expenses – the best way is to set a budget in the first place and follow that with a cashflow forecast.